Renters Insurance in and around Carmel

Carmel renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Indianapolis

- Avon

- Broad Ripple

- Brownsburg

- Carmel

- Castleton

- Fishers

- Geist

- Greenwood

- Irvington

- Meridian Kessler

- Noblesville

- Nora

- Plainfield

- Speedway

- Westfield

- Zionsville

- Hamilton County

- Marion County

Insure What You Own While You Lease A Home

No matter what you're considering as you rent a home - location, outdoor living space, size, townhome or condo - getting the right insurance can be crucial in the event of the unanticipated.

Carmel renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

When the unpredicted vandalism happens to your rented space or home, often it affects your personal belongings, such as a bicycle, a coffee maker or a TV. That's where your renters insurance comes in. State Farm agent Elizabeth Marshall can help you examine your needs so that you can keep your things safe.

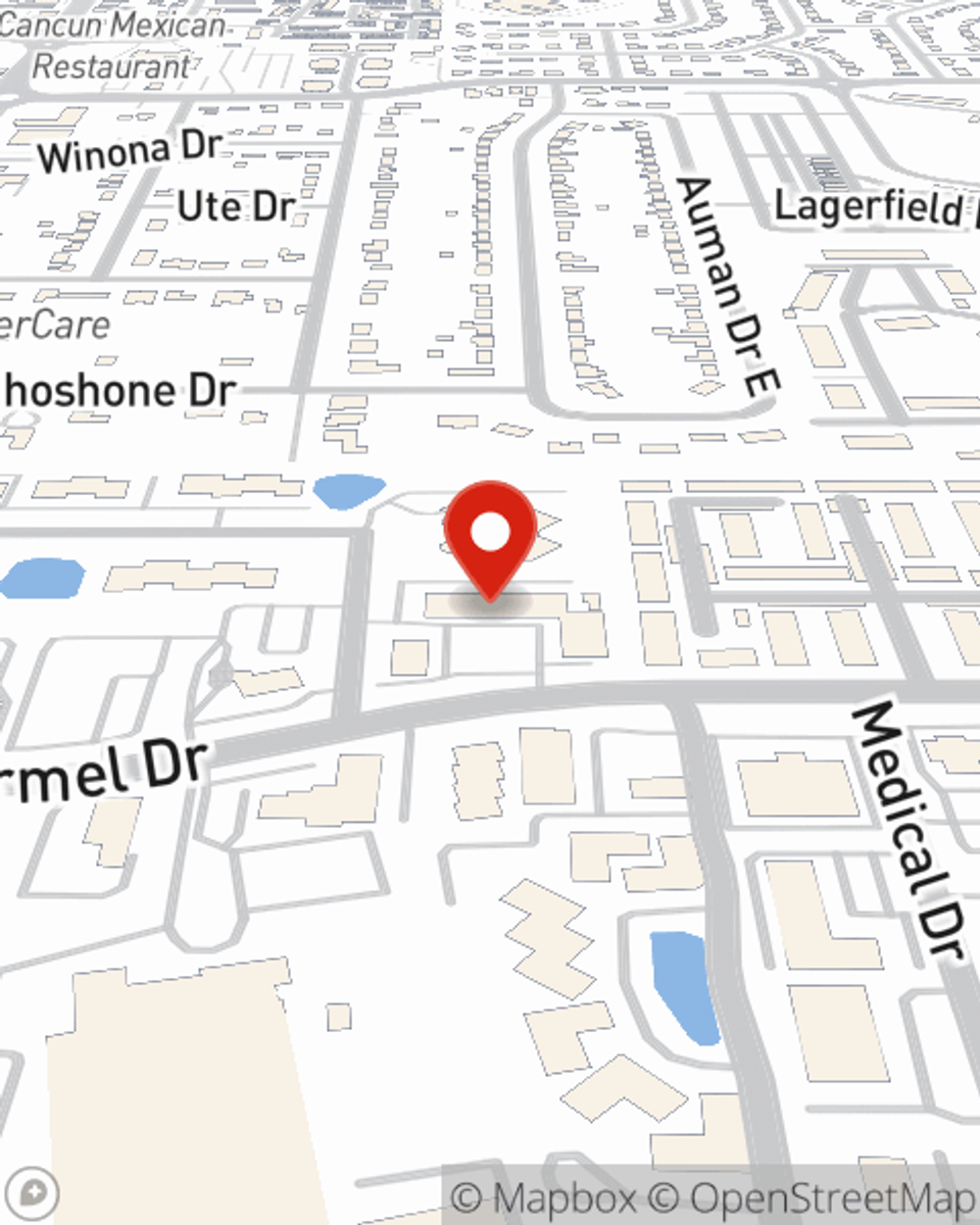

It's always a good idea to make sure you're prepared. Visit State Farm agent Elizabeth Marshall for help getting started on coverage options for your rented space.

Have More Questions About Renters Insurance?

Call Elizabeth at (317) 844-6300 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Elizabeth Marshall

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.